wichita ks sales tax rate 2020

You can print a 75 sales tax. Tax Calculator Wichita Ks TAXW from.

Thomas County Sales Tax Increase Kansas Tax Firm

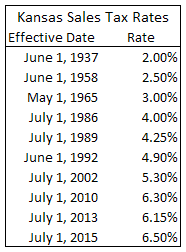

679 rows Kansas Sales Tax.

. The minimum combined 2022 sales tax rate for North Wichita Kansas is. You can find more tax rates. This rate is the sum of the state county and city tax rates outlined below.

The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick County sales tax. In 2020 it was 32749 based on the Sedgwick County Clerk. Wichita County in Kansas has a tax rate of 85 for 2022 this includes the Kansas Sales Tax Rate of 65 and Local Sales Tax Rates in Wichita County totaling 2.

2016 2017 2018 2019 2020 wichita falls city 0705980 0705980 0729880 0763323 0763323 wichita falls isd 1230000 1230000 1220000 1150000 1146400. What is the sales tax rate in North Wichita Kansas. Effective April 19 2022 the Willacy County Tax Office lobby hours will be changing to.

There is no applicable city tax or special tax. These are for taxes levied by the City of Wichita only. In this instance 75 is the minimum rate.

Including local taxes the kansas use tax can be as high as 3500. The Kansas sales tax rate is currently. This is the total of state county and city sales tax rates.

State of Kansas 650 Total Sales Tax 750. Tax Calculator Wichita Ks TAXW from. Kansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 4.

The 75 sales tax rate in Wichita consists of 65 Puerto Rico state sales tax and 1 Sedgwick County sales tax. The kansas state sales tax rate is currently. The County sales tax.

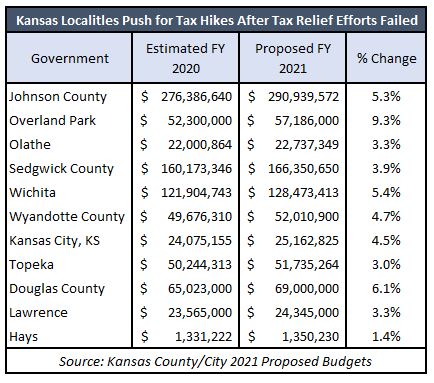

Ad Lookup Sales Tax Rates For Free. 2006 to 2015 sales tax revenues grew at an average of 25 per year. This is the total of state and county sales tax rates.

This rate is the sum of the state county and city tax rates outlined below. The kansas state sales tax rate is currently. Wichita KS Sales Tax Rate The current total local sales tax rate in Wichita KS is 7500.

Wichita ks sales tax rate. However beginning in the third quarter of 2016 sales tax revenue began to slow. This is the total of state county and city sales tax rates.

Average Sales Tax With Local. With local taxes the total sales tax rate is between 6500 and 10500. The minimum combined 2022 sales tax rate for Wichita County Kansas is.

The minimum combined 2022 sales tax rate for Wichita Kansas is. Tax Calculator Wichita Ks TAXW from. The state sales tax rate in Kansas is 6500.

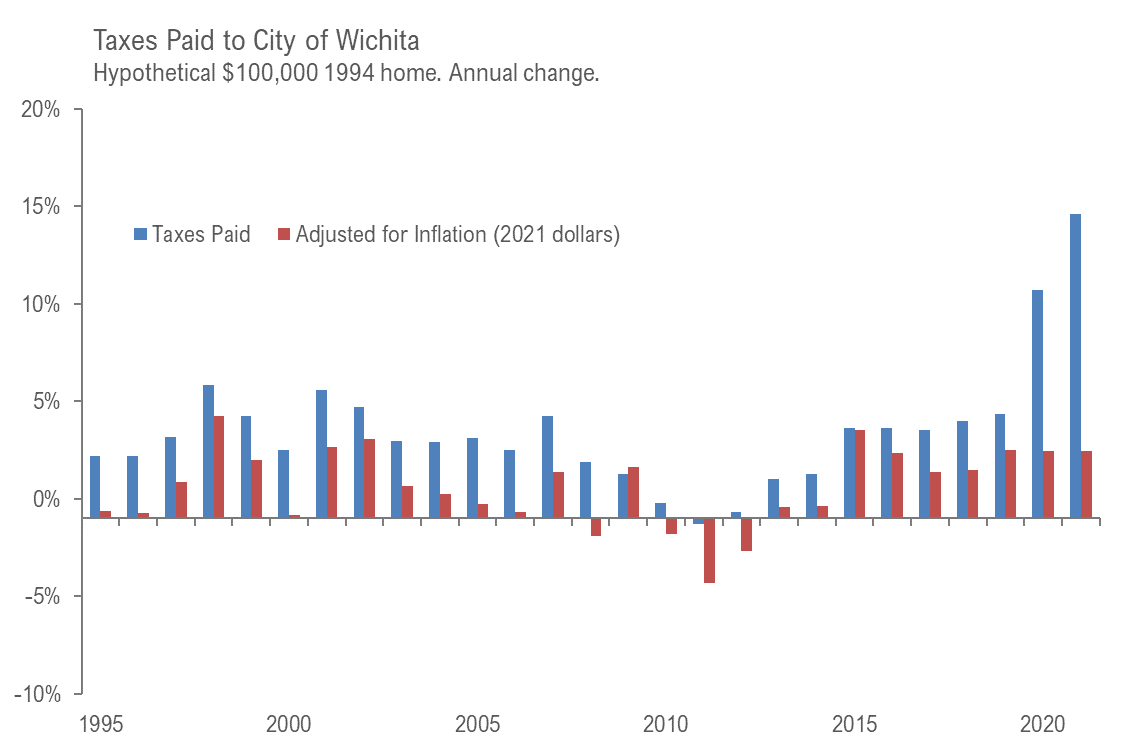

Thats an increase of 1459 mills or 466 percent since 1994. This rate is the sum of the state county and city tax rates outlined below. Tax rate wichita douglas market development cid.

The December 2020 total local sales tax rate was also 7500. However the rate for your business may vary. The kansas state sales tax rate is currently.

For more information download a city and zip code tax rate table from the Kansas Department of. The December 2020 total local sales tax rate was also 8500. Interactive Tax Map Unlimited Use.

It is valued through the Wichita Falls Tax Office for 107000. Kansas has recent rate changes Thu Jul 01 2021. However sales tax grew by 34 in.

3 lower than the maximum sales tax in KS. The Wichita County Kansas sales tax is 850 consisting of 650 Kansas state sales tax and 200 Wichita County local sales taxesThe local sales tax consists of a 200 county sales. There is no applicable city tax or.

Wichita County KS Sales Tax Rate The current total local sales tax rate in Wichita County KS is 8500. What is the sales tax rate in Wichita County.

Schmidt Kelly Ring Up Intriguing Campaign Narratives About Kansas Sales Tax Rate Kansas Reflector

Governor Laura Kelly S Plan To Axe The Food Tax What They Re Saying Governor Of The State Of Kansas

Which Counties Pay The Most Taxes In Kansas You Ve Probably Guessed Correctly Wichita Business Journal

Kansas Sales Tax Guide And Calculator 2022 Taxjar

Register Of Deeds Sedgwick County Kansas

Texas Sales Tax Rates By County

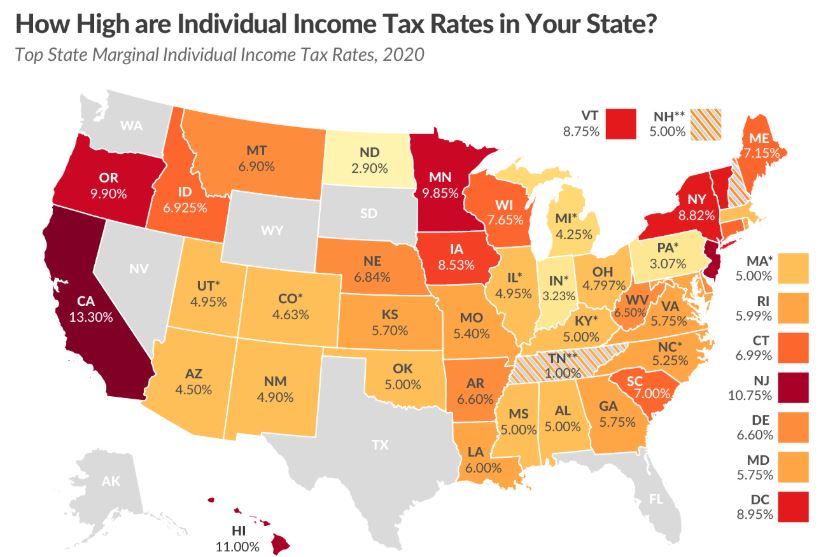

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

11006 E Kellogg Dr Wichita Ks 67207 Loopnet

Wichita Property Tax Rate Up Just A Little

Wichita Kansas Ks Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Fiscal Policy Report Card On America S Governors 2020 Cato Institute

Wichita Kansas Ks Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Kansas Department Of Revenue Sales Retailers

/cloudfront-us-east-1.images.arcpublishing.com/gray/2YXRYZQZPND75FXD5B677KCNBM.jpg)

Homeowners Across Sedgwick County Likely To See Rise In Property Taxes

Kansas Annual Revenue Hits 9 75 Billion On Rising Income Sales Tax Collections Kansas Reflector

Kansas Counties And Cities Hike Taxes Amidst Covid Recession Kansas Policy Institute

Kansas S High Food Sales Tax Rate Draws Bipartisan Opposition The Kansas City Star

Kansas Has 9th Highest State And Local Sales Tax Rate The Sentinel